The exact steps required when electing S-corporation status will depend on whether you have already formed a corporation or LLC. If you have not yet registered your business, check out our more specific guide on forming an LLC. The guide below outlines the most common steps to electing S-corp status as either an LLC or a C-corp, but you should always do research into the specific requirements https://www.quickbooks-payroll.org/ of your jurisdiction. You can contact the agency that regulates income taxes in your state for more detailed information on any requirements of S-corp election. Either type of business can choose to be taxed as an S-corp, but the typical reasons for choosing S-corp status vary. An S corporation must file its annual tax return by the 15th day of the third month after the tax year ends.

Start A Limited Liability Company Online Today with ZenBusiness

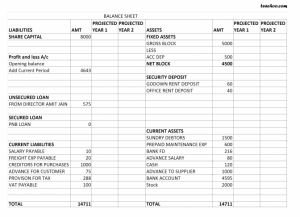

Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 InstructionsPDF, for where to report the estimated tax penalty on your return. If you organize your business as an S-corporation, you can classify some of your income as salary and some as a distribution. You’ll still be liable for self-employment taxes on the salary portion of your income, but you’ll https://www.business-accounting.net/arrears-payment-what-it-means-to-be-in-arrears/ just pay ordinary income tax on the distribution portion. Depending on how you divide your income, you could save a substantial amount of self-employment taxes just by converting to an S-corporation. A sole proprietor who files with an EIN can view their business balance due, business tax records, business name and address on file, and select digital notices.

Why does the federal government offer S-corp status?

You must file your extension request on or before the filing deadline of your return. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. Transcripts are print-outs of the most important highlights from a tax return. In many cases, you may only need a transcript and not a full copy of your tax return. Besides transcripts of your tax return, find out what other types of transcripts you can request from the IRS.

Reasonable Salary

- To contrast, C-corp shareholders are not allowed to write off corporate losses to offset other income on personal income statements.

- This penalty applies each month or partial month the tax is late, up to 25 percent max.

- South Africa’s governing African National Congress (ANC) and the main opposition Democratic Alliance (DA) have agreed to form a government of national unity, along with two smaller opposition parties.

- Information regarding your salary will appear on your Form W-2, which you’ll need to report on your individual tax return.

- Corporations typically elect S-corp status to avoid double taxation of distributions.

Though advantageous for fast-growing firms, they are also subject to certain restrictions on their size and shareholders by the IRS, which could eventually inhibit their expansion. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. As CEO and founder of Carl’s Sandwiches, you earned a $60,000 salary in 2019, and the company also earned a net profit of $200,000 that year, which you’re entitled to 50% of—or $100,000. This credit card is not just good – it’s so exceptional that our experts use it personally.

When you work for someone else, you’re only responsible for part of these taxes, while your employer pays the balance. However, if you’re self-employed, you have to pay both portions of this tax. The combined employee and employer portions of this tax amount normally amounts to 15.3 percent. This follows weeks of speculation about who the ANC would partner with after losing its parliamentary majority for the first time in 30 years, in last month’s elections.

S-corporation taxes

Corporations differ from sole proprietorships, partnerships or LLCs in a variety of ways. The shareholders own stock in the company, the directors set policies and oversee the “big picture,” and the officers run the company day-to-day. An S corp (or S corporation) is a business structure that is permitted under the tax code to pass its taxable income, credits, deductions, and losses directly to its shareholders. Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments.

If you’re a calendar year corporation—that is, if your fiscal year lines up with the calendar year—you’ll have to file your S corporation return by March 15th of this year. Some of the payees involved in running your business might require a 1099-MISC form instead of a 1099-NEC. Keep in mind that the February 28 due date only applies if you’re filing a paper copy. The IRS requires all employers to pay the federal unemployment tax, and most states also require them to pay unemployment taxes of their own.

To form a new S-corporation, you must first file Articles of Incorporation for an LLC or a C-corporation. Once the Articles of Incorporation are on file with the state in which the business operates, Form 2553 must be filed with the IRS to elect S-corporation tax status. The change in tax status must be completed within two months and 15 days of the beginning of the tax year for the change to take effect in that tax year. Like a traditional corporation, an S corporation must file an annual federal tax return. However, because an S corporation is a pass-through entity, more of the information included on an S corporation’s federal tax return is for informational purposes than a traditional corporation’s tax return. Treasury proposed S-corp status as a solution that could give smaller American businesses a leg up in an increasingly conglomerated corporate landscape.

Estimated tax requirements are different for farmers, fishermen, and certain higher income taxpayers. Publication 505, Tax Withholding and Estimated Tax, provides more information about these special estimated tax rules. The IRS tends to take a closer look at S-corporation returns since the potential for abuse is so large. For example, if you make $500,000 in one year but only designate $20,000 of that as salary income, you might trigger an IRS inquiry, since you are avoiding so much self-employment tax. The guiding principle is that you must designate a “reasonable” amount of your income as wages, rather than a distribution.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. With cover sheet Form W-3, the forms get sent to each employee, the Social Security Administration (SSA), and state and local governments. Work from home may also deduct the percentage of your home used exclusively for business. Corporations must deposit the payment using the Electronic Federal Tax Payment System. The ANC led by Nelson Mandela led the campaign against the racist system of apartheid in 1994 and won the country’s first democratic elections.

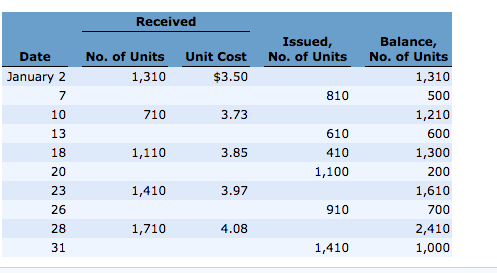

This form is known officially as Election by a Small Business Corporation. The remainder of the form includes other key information, which is noted in the table below. A shareholder’s profit and loss are relatively easy to calculate if they don’t see a worker misclassification: why the irs cares & you should too change in the percentage of the shares they hold during the year. But if the shareholder purchases, sells, or transfers any (additional) shares or holdings during the course of the year, then their profit and loss must be prorated on a per-share basis.

Form 2553 is due no more than two months and 15 days after the beginning of the tax year for which the election is to take effect, or any time during the preceding tax year. The instructions for Form 2553 provide several examples to help you calculate this deadline. But you should try to base it on position, experience, business size and what a comparable position at another company in your industry would earn. Whatever salary you decide on, be sure you’re able to justify it to the IRS if you ever get audited. Because Carl’s Sandwiches is an S corp, you’ll only have to pay self-employment tax on the $60,000 salary, and not on the $100,000 distribution. Get a detailed breakdown of how to elect for S corp status with the IRS.

Read on for a guide to preparing and filing corporate income tax returns. That means that instead of an S corporation itself paying federal tax on its business profits, the obligation to pay those taxes passes through the corporation to the individual shareholders. However, this doesn’t mean S corporations themselves are simply ignored by the IRS. On the contrary, an S corporation definitely is recognized by the IRS as a separate entity from its shareholders—and is required to file various returns and other forms with the IRS.

The IRS treats stock as being in one class if all shares have equal rights to distribution and liquidation proceeds. Because LLCs do not issue stock, it’s best to consult with a lawyer or accountant to find out how this requirement applies to your business. For more specifics, check out our guide on S-corps or our other articles on the advantages and disadvantages between LLCs and S-corps and the differences between C-corp and S-corp elections. Both parties in Congress at the time had shared concern over the tremendous wealth and power a small number of multinational corporations were consolidating. In an effort to help small businesses stay competitive, the Treasury proposed a solution that could give small, American businesses a leg up—at least until they reached a certain size.